In response to the deepening property crisis, the Chinese government has recently unveiled a series of rescue packages aimed at propping up the property market. The latest is to allow local governments to purchase unsold homes using special bonds. These bonds, which were previously restricted to infrastructure and environmental projects, would now be redirected toward buying up surplus properties. The government’s decision came nearly a month after the third plenum held in mid- July. The plenum kicked off as China reported its slowest rate of economic growth in April-June since the first quarter of 2023, weighed down by a protracted property down-spiral and weak demand from cautious consumers.

Another significant factor behind the move was reports of foreign investors who have almost lost confidence in the Chinese government with regard to the real estate crisis. Available reports indicated that foreign investors have been showing reluctance to commit capital to China’s commercial properties. According to Nikkei Asia report, cross-border deals in China’s commercial property market totalled just 3.3 billion US dollars from January to June 2024, a 13 percent decline compared to the previous year.

This decline was a reflection of growing concerns about the long-term viability of investments in China’s real estate sector. Christine Li, the head of research at real estate consultancy Knight Frank, highlighted this sentiment, stating, “We have seen some concerns, particularly from the U.S.-based real estate investors. Five to seven years down the road, whether you can find a buyer to exit the Chinese market, is a big question mark.” This uncertainty has led many investors to reconsider their involvement in China’s property market, further exacerbating the crisis.

Besides, traditional investors like Singapore’s sovereign wealth fund GIC, once a major player in China’s property market, too have started to pull back. GIC’s Chief Investment Officer Jeffrey Jaensubhakij warned that China has “come to the end of its growth model” that relied heavily on real estate development. This shift in perception among long-term investors underscores the deepening crisis of confidence and raises questions about the future of China’s economic growth model.

According to Canada based Asia pacific foundation, Beijing has failed to offer any concrete solutions to critical challenges such as the real estate crisis and youth unemployment. The property slump has eroded an estimated 15–20 per cent of household net worth over the past three years.

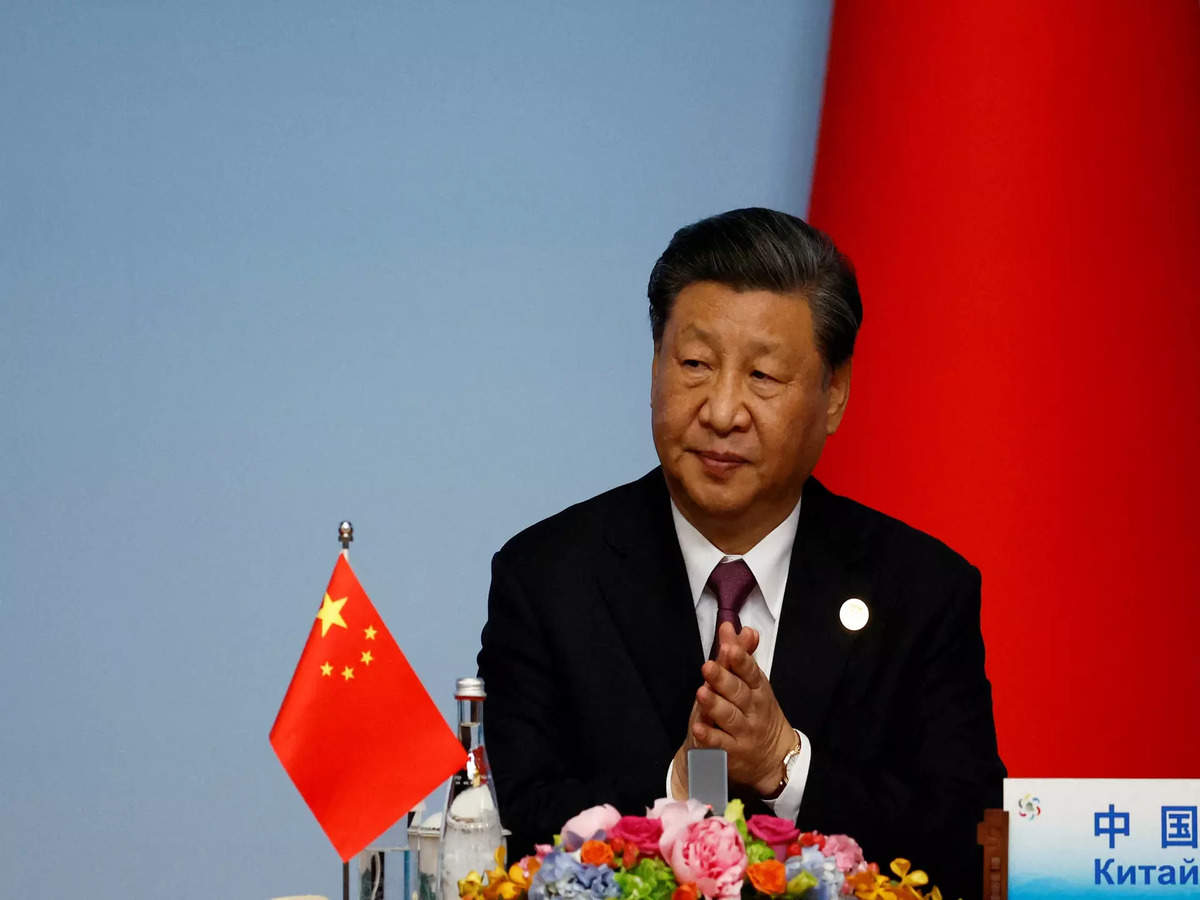

The property crisis in China, which has been unfolding for several years, is not merely a result of market dynamics or external factors. It is essentially due to wrong policies and mismanagement by the Chinese government under President Xi Jinping. Ever since he took over in 2013, Xi’s administration has implemented several strategies that have backfired, leading to a significant loss of confidence among the Chinese people, foreign investors, and the global community.

For decades, China’s property market was seen as a critical engine of economic growth. Under previous administrations, particularly during Hu Jintao’s tenure, the sale of land usage rights became a primary method for local governments to fund their budgets. This approach led to a significant rise in land prices as property developers competed for government contracts. As a result, a property bubble began to form, with skyrocketing housing prices making it increasingly difficult for average Chinese citizens to afford homes.

When Xi Jinping came to power, he introduced a new vision for China’s economy, which included curbing speculation in the real estate market. In 2017, Xi famously declared that “homes are for living in, not for speculation,” signalling a shift in government policy. However, this statement failed to account for the complexities of the property market. Instead of stabilizing the market, it led to a sharp decline in demand for real estate, as investors pulled out and developers found themselves with unsold properties.

Contrary to Xi’s intention to reduce speculative investments, his policies have resulted in a significant slowdown in the property market. This downturn has hit property developers hard, particularly those who had borrowed heavily to finance ambitious projects. Many of these developers, including giants like Evergrande and Country Garden, have since defaulted on their debts, leading to a cascading effect throughout the industry.

The property crisis has adversely affected local governments. That’s because these governments have relied on revenue from the sale of land usage rights to fund their budgets for years. As the property market slowed, this revenue stream dried up, leaving local governments financially strained. That affected essential services and social programmes. This financial strain led to growing concerns about the sustainability of local government finances and the potential for widespread social unrest.

While the special bond concept underscores the urgency of the situation, it is unlikely to provide a long-term solution. The effectiveness of this approach is limited by the low rental yields in major cities like Beijing, where rental returns are lower than the cost of borrowing. This financial mismatch makes it difficult for local governments to recoup their investments in unsold homes, raising questions about the viability of this strategy. The issuance of special bonds to fund these purchases only adds to the debt burden of local governments. With more than half of the 534.3 billion US dollars (3.9 trillion yuan) quota for special bonds already used up this year, it is unclear how much of the remaining funds can be allocated to home purchases without exacerbating the debt crisis.