KAMPALA — Ugandan authorities an Inter Agency force to battle economic crimes, the Uganda Revenue Authority (URA) Commissioner General (CG), John Musinguzi said, noting that addressing the threat will spur revenue collections and help the country attain economic independence.

Over time, research shows that the development of economic crime has progressed in parallel with the development of trade and business technologies. As value transmission moved from barter to financial instruments, and the relationships between traders became ever more remote and reliant on intermediaries, so has the scope widened for abuse of the enabling mechanisms that underpin effective trade.

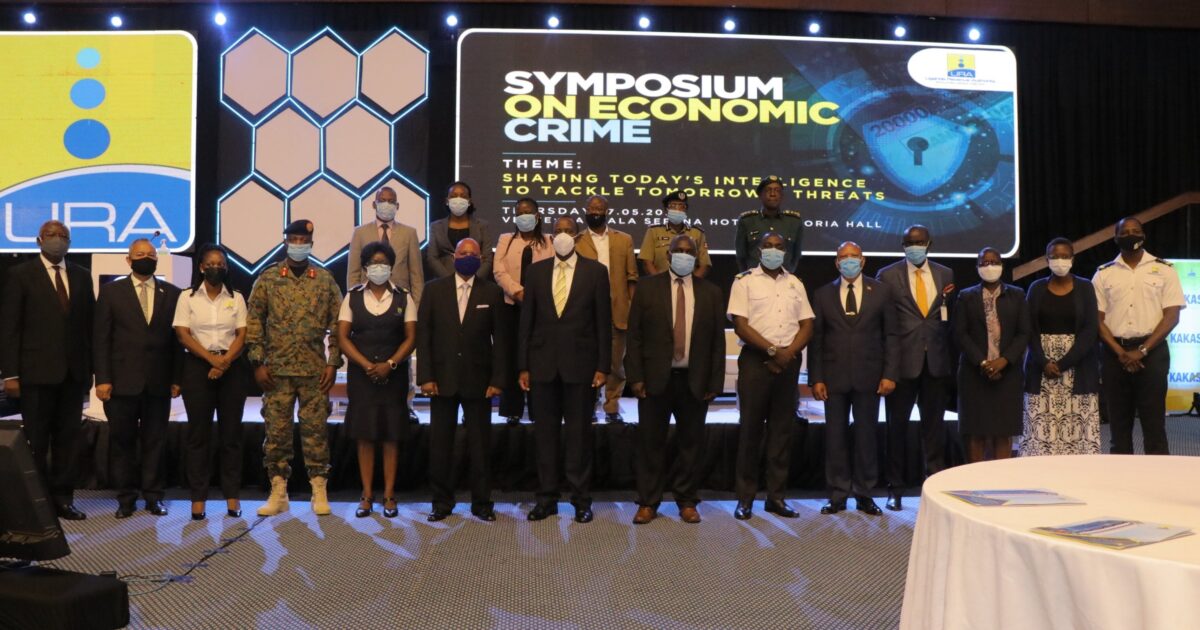

Addressing reporters at the sidelines the one day symposium on Economic Crimes at the Serena Hotel, Mr. Musinguzi said resources that could support a country’s development are lost through economic crime such as corruption, money laundering, smuggling, terrorism financing and tax evasion among others.

He added: ” the Inter agency collaboration in these areas if all agreed upon, we will take on the for of working group charged with comprehensive identification and analysis of economic and financial crimes at strategic, operational and tactical levels leading to targeted enforcement activities.”

Financial and Economic crimes have become a more accessible activity, with experts identifying reduced barriers to entry for undertaking a financial crime, the proliferation of information on the internet and many of the perpetrators conforming to stereotypes of the “hardened criminal.”

For regulators and policymakers, economic crime in a digital age presents some particular challenges in addition to those dealt with before.

These include, at a minimum, challenges pertaining to anonymity, accessibility and accountability.

The Government of Uganda has over the past years initiated mechanisms to combat economic crime. These include; review of the legal framework, strengthening of Law Enforcement Agencies (LEAs) and the establishment of various structures (e.g. the Internal Security Organization Economic Desk, Police Cybercrime Unit, the Financial Intelligence Authority, and the Anti-Corruption Court, etc.

But experts warn that the laws and regulations would not only be those relating, for example, to money laundering, corruption and tax evasion — but also those concerned with data protection, environmental impact and the treatment of the workforce, among other concerns.

“For all these institutions that you have seen, there is an existing collaboration. We work with the army in enforcement, we work with the Police in investigations, we work with Immigration at the border and entry points to collect revenue and scan what is coming into the country, we work with the DPP for prosecution, we work with URSB for registering entities, we work with the Bank of Uganda (that’s where we deposit the revenue we collect on a daily basis, we work with the State House Anti-Corruption as we get rid of corruption in the institution, we work day to day with all these agencies that we have convened here but the purpose of this symposium is that we can’t put our heads together and see how to take this collaborations to the next level,” Musinguzi said, adding that… this is a journey we cannot walk alone or it’s not a journey where we can do business as usual. So, we thought of this symposium because economic crime is key at the heart of revenue leakages. Smuggling is part of economic crime, tax evasion and planning is part of economic crime (people who falsify documents to dodge revenue, money laundering is part of economic crime. So, all these are real threats in our journey to move our country to economic sufficiency and therefore, we thought it’s important to call on the stakeholders, sit on a round table, have our technical teams discuss how we can do the collaboration we have been doing better. How can we be more efficient so that we close all the revenue leakages and we collect enough revenue that will develop our nation.”

Former Internal Affairs Minister, Gen. Jeje Odong who presided over the symposium commended the idea to involve all arms of government in the fight against economic crimes.

“Economic crimes are tasks that cover various agencies. They cover agencies that come in contact with the society. They cover the agencies that must deal with certain aspects of criminality,” he said.

one of the institutions that picks money in collaboration with URA is the immigration. Now, if the immigration department works in isolation and does not link with URA, there will be a missing gap. So, the immigration department must work in collaboration with URA. One of the institutions that provide a significant amount of information to URA is NIRA. If NIRA does not collaborate with URA, then many individuals who may have tax obligations can go unnoticed. URA must therefore be able to link up with information and data available in NIRA for that purpose. If a crime is identified, URA in itself may not have the capacity to investigate. So, it must depend on the investigative arms of the government like the intelligence agencies as well as the CID department of police. So, it is in this respect that collaboration is of very significant importance. URSB, for example, registers different companies. If that information is not available to URA, such companies can go scot-free without meeting their tax obligations.”